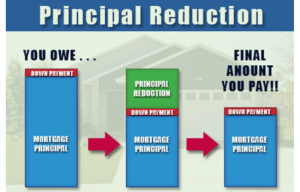

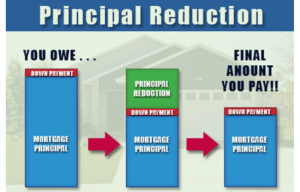

FHFA Announces Principal Reduction Modification Program

FHFA has recently announced a program that is meant to reduce principal on owner occupied residential mortgage loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

Here are some of the guidelines for the principal reduction program:

- Must be owner occupied

- Have to be behind at least 90 days as of March 1, 2016

- Fannie or Freddie have to either own or have guaranteed the loan

- Outstanding principal balance must be no more than $250,000

- The market loan to value must exceed 115%

- Earnings are capitalized

- The interests rate is reduced

- If Market loan to value is greater than 115% than it is reduced to equal 115%, the difference is not capitalized if the borrower makes all payments on time.

See full list here: Click Here

This is just another option available to New Jersey homeowners but there is always the option of selling before it is too late.

If you are thinking of selling your house or are curious on how the process works… and want to see what we can pay you for your house… you can get that ball rolling in a couple ways.

Give us a call today at (908) 912-6701: We’ll ask a few basic questions about your house… and within 24 hours we’ll make you an offer on your house. No Obligation at all. If the price works for you. Great! We can close on your timeline… in as little as 7 days.

Go fill out this really short and simple form with your basic house info: We’ll evaluate the property as soon as we get it today… then we’ll call you with a formal offer on your house in less than 24 hours.

It’s really simple. You pay no fees. No commissions.

www.webuynjpropertycash.com

No comments:

Post a Comment