When planning your estate and preparing for your death, you’re required to lay out a comprehensive last testament and consequently name an Executor for it. This is the

individual who will represent you in the execution of your last wishes after you’ve passed away, hence the need to pick out a person whose

character, dependability and integrity are in agreement with your needs and values. That notwithstanding, Executors face a

number of challenges when selling a home through

probate.

#1 – Large Probate Estate

Consider the size of the deceased’s estate directly proportional to the challenges of the Executor, the larger the probate estate, the harder the Executor’s work.

For probate estates valued in the millions, you’ll be kidding yourself to think that you can handle it all on your own. You will definitely need some expert help in auditing and valuation, because such big estates are predisposed to taxes on both the state and federal level.

As an Executor, you’re mandated to oversee the settlement of all the estate’s liabilities and taxes should be top on that list. This is a sensitive and serious aspect that should be treated with as much gravity for larger estates attract more liabilities.

#2 – Additional Expenses

One of the greatest fears that many Executors confess to is that of financial liability otherwise known as fiduciary responsibility.

Countless expenses are incurred when selling a house in probate. As if that’s not enough, the entire probate process is expensive enough, leaving more and more people strongly considering any other alternatives just so they can avert probate.

In reality, Executors are not expected to dip into their pockets per se (unless if voluntarily), but it is their responsibility to ensure tip-top management of the deceased’s estate; and with an expectant survivorship looking up to the Executor for their inheritance, any additional expenses funded from the estate are a burden enough.

#3 – Dissatisfaction of Heirs/Beneficiaries

There are countless situations that could bear dissatisfaction from the heirs and beneficiaries, with the Executor on a strategic receiving end. Discontentment and discordance amidst the beneficiaries can be the most emotionally overbearing challenge Executors face, and it doesn’t make it any easier if the Executor is a member of the deceased’s family, or one among the named beneficiaries.

There could an unimaginable number of reasons for tension amongst beneficiaries of an estate (with jealousy and inbred rivalry coming top on the list).

It’s unbelievable how heirs can become utterly stubborn and difficult to deal with! They can adeptly complicate the Executor’s work with issues such as sibling rivalry, perceived “unfair sharing” among many other concerns (petty or otherwise). The beneficiaries undeniably come out tops as the greatest culprits in making the Executor’s life as unbearable as can be during the entire probate period.

#4 – Finding a Buyer – Getting a Good Price

Would you rather buy your takeout straight from the counter or get it at home after you’ve had to enter a contract with the food joint, given them your credit card details, home address, health records (food allergies and all)—the whole nine yards?

A great deal of protocol is involved in the selling and buying of probate houses, and home buyers aren’t the biggest fans of such protocol, wouldn’t it be easier to just get your takeout without the formalities of a travel visa? From not-too-pleasing disclosure forms to appearances at court hearings and a transaction that could take so long to mature; it’s not hard to see why many buyers shy away from houses in probate.

On the flip side, some home buyers believe that they can strike a better deal and hence get greater bargains when buying a house in probate and this could be a selling point for Executors

looking to make a quick-home sale. It’s one thing to find a buyer and a whole other to get a good price, both of which can prove challenging for the Executor, and especially to those with no prior experience as executors of an estate.

#5 – Time Taken to Sell the House in Probate

The duration could be shorter if the Executor is granted full authority to process the transaction without necessarily going to court for an approval. However, if the Executor acquires limited authority to sell the probate house, then it could take a long while before the house is actually sold.

It could be anything from a few months to over a year, between the Executor’s petition to sell the house and the actual transfer of property title to the new owner. For everyone’s sake, it’s important not just for the Executor to know this and hence be psychologically prepared, but also for all other involved parties to get in on this fact.

The beneficiaries could cause a stir if it takes longer than anticipated, and the buyers might threaten to sue. By putting everyone on the same page, you’ll be making your life and work so much easier.

From dealing with multiple parties to acting as the pacifist among feuding beneficiaries, to being liable as a fiduciary trustee of the estate, the Executor’s job is not as fun as shooting hoops but it doesn’t have to be as hard it’s imagined to be. If you’re elected as an Executor, know what’s expected of you, acquaint yourself with the highs and lows of the job!

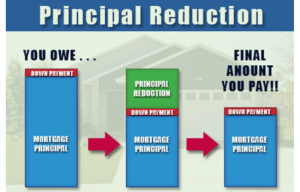

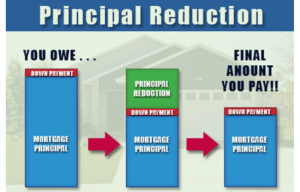

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater. loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

loans. This affects roughly 33,000 mortgages that are significantly underwater according to reports in Housingwire and National Mortgage News. The good news is that NJ has the highest portion of those houses that are significantly underwater.

expensive home repairs can make the difference between a great deal and a loss. Oftentimes, prospective home buyers decide relatively quickly whether or not they want to buy a house. Whether it’s because of the great curb appeal or the huge closets, potential home buyers can hold on to the property’s great features while ignoring or downplaying the negatives. However, these snap or emotional decisions could cost the home buyer thousands upon thousands of dollars and hours of stress. In this article, the We Buy Houses NJ team gives New Jersey home buyers the information they need to avoid the most costly home repairs. Read on below to learn how to identify and avoid 5 costly home repairs.

expensive home repairs can make the difference between a great deal and a loss. Oftentimes, prospective home buyers decide relatively quickly whether or not they want to buy a house. Whether it’s because of the great curb appeal or the huge closets, potential home buyers can hold on to the property’s great features while ignoring or downplaying the negatives. However, these snap or emotional decisions could cost the home buyer thousands upon thousands of dollars and hours of stress. In this article, the We Buy Houses NJ team gives New Jersey home buyers the information they need to avoid the most costly home repairs. Read on below to learn how to identify and avoid 5 costly home repairs.